What is Consignment Auction?What is the effect of consignment auction in China's carbon market?

According to a recent research by Duan Maosheng, a Professor and Deputy Director of the Institute of Energy, Environment and Economy, Tsinghua University, consignment auction has most of the advantages of free allocation and auction, especially suitable for the early stage of carbon market establishment.The paper named Consignment auctions of emissions trading systems: An agent-based approach based on China’s practice was published in Energy Economics.Duan Maosheng is the corresponding author, and Wang Baixue, a doctoral student of Tsinghua University, is the first author. The research was supported by the National Social Science Fund of China.

Policymakers of emissions trading systems (ETSs) around the world are faced with the challenges of how to allocate carbon allowances. On one hand, the free allocation would undermine the efficiency and fairness of ETSs, while on the other hand, a precipitous shift to auctions would put enormous economic pressure on covered entities. The consignment auction is supposed to combine the free allocation and the auction. However, few studies have investigated the consignment auction’s impacts on ETSs and commodity markets from a quantitative perspective.

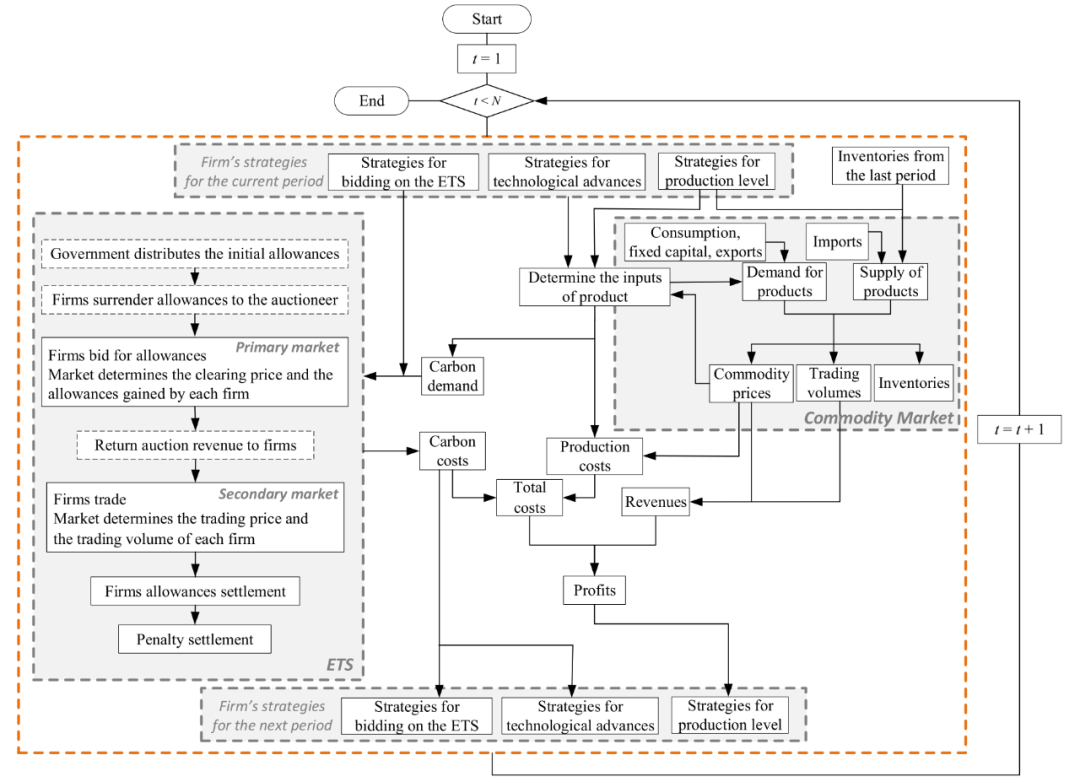

In this paper, an agent-based model is proposed, considering both the primary and secondary carbon markets, the commodity market and the behavior of firms. Simulation results based on China’s data show that, compared with the free allocation, the consignment auction can achieve a higher and more stable carbon price without significantly increasing the cost borne by firms, increase the liquidity of ETSs, and stimulate the technological advances of firms. Compared with the auction, the consignment auction reduces the volatilities of the commodity market induced by ETSs and facilitates the smooth operation of ETSs.

The results also suggest that the consignment auction is particularly suitable for the early stage of ETSs, while the auction remains the best allocation method as the ETS matures, as it significantly promotes long-term technological advances.

The link to the paper is https://doi.org/10.1016/j.eneco.2022.106187